MyKad Card Police Military Card. FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan.

Guide To E Filing Income Tax Malaysia Lhdn Otosection

Important things to take note about filing Form E.

. Salaries wages allowance incentives etc to be included in the CP8D form. If youre registering for e-Filing for the first time youll need a one-time login 16-digit PIN provided by LHDN. Taken directly from the LHDN website it is cited that referring to Section 831A Income Tax Act 1967 that every.

Most recomended using IE Browser. Individual who are not. Employees remuneration informationie.

Untuk makluman anda juga pastikan anda selesaikan urusan E Filing Income Tax ini dalam masa yang telah ditetapkan. E - Janji Temu. Employer is not required to send notification using CP22 to the IRBM if.

E Filing ini boleh di isi melalui Laman Web Rasmi LHDN iaitu di Portal ezHAZIL. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification. BNCP dan borang anggaran yang disediakan.

Now that youve registered as a taxpayer youll need to register for e-Filing on the ezHASiL platform. The new employee is not subject to income tax. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai.

The reason you need this is to ensure that if you are above the paygrade that requires you to pay taxes the form ensures that you are aware of this and this is the form you use when you go online and do your E-Filing. Pembayar Cukai Taksiran Tahunan 2021 boleh mula mengisi E Filing LHDN bermula pada akan dikemaskini 2022. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand.

Further education fees self. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Untuk yang baru bekerja atau baru memulakan perniagaan ini cara daftar LHDN pertama kali sebagai sebelum memulakan e-filing.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. The application must be attached with the following documents. You only need to make a minimum spending amount in a month on the Online Dining and Contactless categories combined to earn 5 cashback capped at RM30 a month.

IRB no longer accepts manual forms. Return Form RF Filing Programme. As the name suggests this will be done automatically by the system.

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website. All Right Reserved e-Apps Unit Department of e-Services Application Inland Revenue Board of Malaysia.

Frasa keselamatan adalah bertujuan untuk memastikan pembayar cukai log masuk ke laman sesawang ezHASiL yang. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application. Ia bukan saja menjadi tanggungjawab kita sebagai rakyat Malaysia sebenarnya daripada pengisytiharan cukai kita di LHDN juga institusi kewangan mudah untuk membuat perhitungan dan meluluskan pinjaman bank.

What are the Features and Benefits of UOB Credit Cards. Use e-Daftar and register as a taxpayer online. If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number.

After filing retain a copy of the forms for your records. Employers Responsibility The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

With that heres LHDNs full list of tax reliefs for YA 2021. Self parents and spouse 1. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. With UOB YOLO Visa you will not be going to miss out on the latest food and online trends anymore. All MTD PCB calculation have to be done online using PCB calculator payroll system or LHDNs own e-PCB system.

Steps To Apply E Pin Online L Co

Steps To Apply E Pin Online L Co

How To File Income Tax In Malaysia Using Lhdn E Filing Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

How To Reset Lhdn E Filing Password The Money Magnet

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

How To Reset Lhdn E Filing Password The Money Magnet

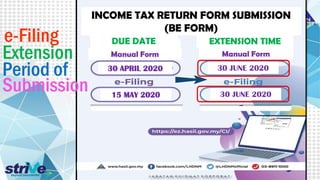

Lhdn Officially Announced The Deadline For Filing Income Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

How To Step By Step Income Tax E Filing Guide Imoney

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Lhdn Update And Amend Wrongly Tax Filing Malaysiasky

Ctos Lhdn E Filing Guide For Clueless Employees

How To Submit Income Tax 2019 Through E Filing Lhdn Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Zenflex Lhdn E Filing Tools Otosection

- projek sejarah tahun 4

- doa sholat taubat nasuha

- gajah putih adalah sebutan negara

- gambar potong rambut pendek lelaki

- gambar pisau tajamkartun hitam putih

- kalendar oktober 2018 malaysia

- undefined

- e filing lhdn online

- potongan rambut layer lelaki

- minyak zaitun sebagai minyak rambut

- kereta termahal sultan brunei

- jabatan integriti dan pematuhan standard

- chalet di teluk batik

- desa bukit jambul

- mr grey episod 2

- kawad kaki polis

- taman pagoh jaya

- contoh surat permohonan bank gerenti

- doa dipermudahkan urusan

- maximum working hours in malaysia